Tax Checklists

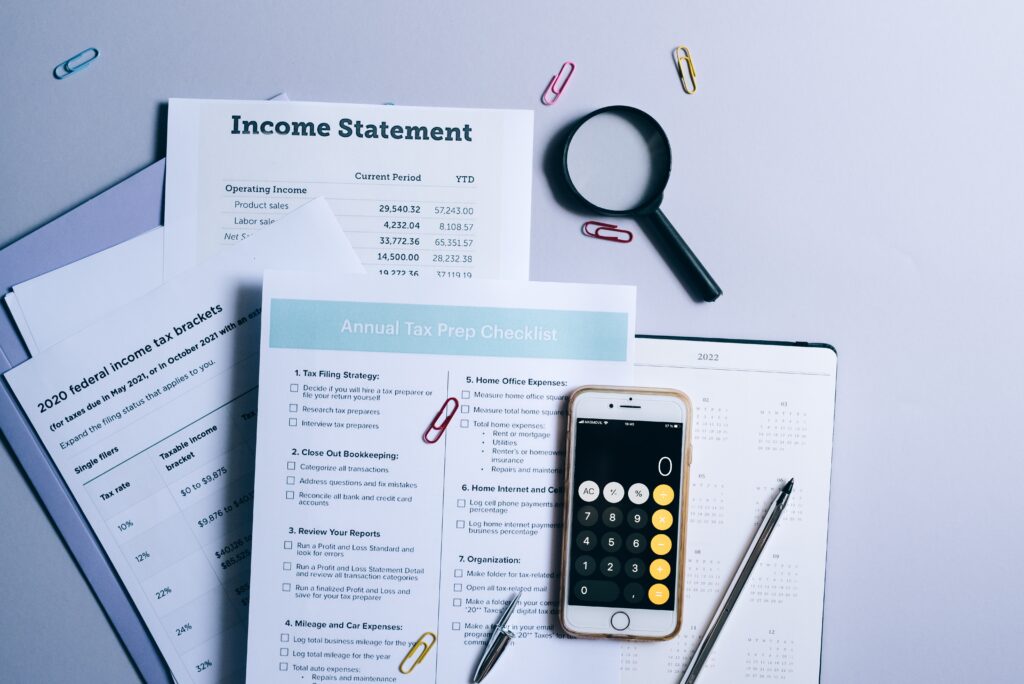

Don’t stress this tax season. Download a tax checklist so you don’t miss any tax deductions.

Need a tax checklist? Get a custom checklist for your job, for free, below

A tax checklist, tailored to your job that you can download for free!

We’ve developed practical tax checklists designed for well-known occupations to assist you in refreshing your memory and finding all the necessary paperwork for your taxes at once.

These tax checklists include job-specific tax deductions that could increase your return, such as non-slip shoes for nurses and knives for cooks, as well as sometimes overlooked costs that might add up to a bigger tax refund.

You risk losing out on worthwhile tax deductions if you fail to submit receipts or claims in your tax return. Your tax check list aids in accuracy.

Do Your Tax Return Online in Minutes

Your return will be reviewed and checked by two Itax accountants before lodgement – giving you the confidence it was done right.

Important Dates and Tax Deadlines

For your income between

01 July 2021 – 30 June 2022

For your income between

01 July 2020 – 30 June 2021

All Other Years

You can do your tax return right now, online, with friendly support

How to use your tax return checklist:

1) Pick a tax return checklist from the list below that corresponds to your line of work (or similar). Not finding a match? No issue; generic tax checklists are also provided below.

2) Click the “see blog” link at the bottom of the checklist to learn more about tax deductions that are relevant to you.

3) Please print out your checklist and mark each item as you acquire it, or use it as a reference.

4) Start filing your return online; most individuals complete it in a few minutes.

5) Just call or live chat with an Itaxonline accountant if you have any queries or concerns. No appointments are necessary;

Download a tax checklist here:

Tax Checklist for Nurses

Tax Checklist for Hospitality

Tax Checklist for Freelancers

Tax Checklist for Airline Cabin Crew

Tax Checklist for Chefs and Cooks

Tax Checklist for Office Admin

Tax Checklist for Aged Care Workers

Tax Checklist for Teachers

Tax Checklist for Tradies

Tax Checklist for Retail Employees

Tax Checklist for Truck Drivers

Tax Checklist for Cleaners

Don’t see your job above? Download the general tax checklists below

We’re working on tax checklists for common professions in Australia; as you might guess, it’s quite a task! People have more sorts of jobs than we all tend to think about.

In the meantime, below are Basic and Detailed tax checklists that should help people in all professions. See tips about what tax deductions can be claimed and which documents and numbers you’ll need in order to finish your taxes.

A simple, general tax checklist for all professions

Our basic checklist is suitable for anyone with a simple tax return with little or no additional schedules.

Basic Tax Checklist for your profession

Comprehensive Tax Checklist for your profession

A more comprehensive tax checklist for all professions

Our detailed checklist is suitable for anyone with more complex tax affairs, inc. property investors, etc.